When it comes to retirement, citizens of the US are finding that completely stepping away from any form of income just isn’t always viable. Even with Social Security benefits, things are pretty tight, and many are turning toward part-time work or their own side hustle to ensure financial security in their later chapter of life. But there’s a number of nuances associated with earning in retirement – like how it actually affects your benefits.

Which can make it pretty daunting to step into the world of side-hustles and retirement work!

So, we’ve developed this guide to help you understand how earning in retirement can affect your benefits. And, more importantly, to let you know HOW you can work while receiving Social Security retirement benefits, so you can pad your next chapter of life.

Reasons people choose to earn in retirement

You might be thinking “why would I even bother earning in retirement if it could affect my benefits?” But there’s a number of reasons why individuals turn toward earning money in retirement.

While some delve into their passion projects, finally taking the leap and turning their dream into passive income, others are pushed into side hustles as a financial necessity. Because, for most of us, retirement savings just aren’t enough to cover living expenses.

But it’s also been found that working in retirement can be incredibly beneficial to your overall enjoyment of life. Yes, we know, who’d WANT to work? But working can actually provide structure and purpose and, when you don’t need to do it that same, stressed-out way you did before, it can be pretty nice to get out for a day or two a week, give back to the community, and make a little difference in the world around you.

For a great example of how to find purpose in retirement, see Steve Lopez’s tips here.

How much can I earn in retirement and still receive my Social Security benefits?

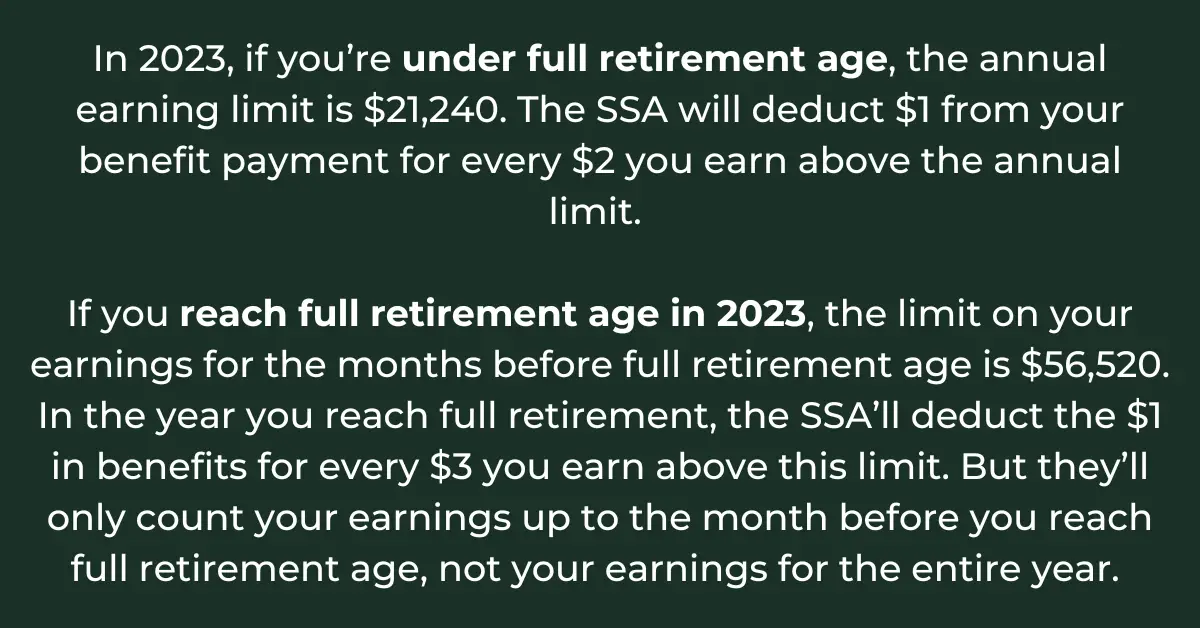

The moment you begin receiving your Social Security retirement benefits, you’re officially considered “retired”. But you can get Social Security retirement benefits and still work at the same time. However, there is a limit to how much you can earn while still receiving your full benefits.

But, starting with the month you reach full retirement age? There is no limit on how much you can earn and receive your benefits.

Which means that, if you are wanting to step into a side-hustle in retirement? Your best bet is to wait until you’ve been in retirement for at least a year, and then viola! It’s all yours!

How are earnings deducted from Social Security benefits?

While you won’t have to worry about there being a limit of what you can earn once you’re in retirement, there’s still some deductions you’ll want to understand.

But even we’re getting a bit foggy, it can’t be that easy right? Maybe it’s that complicated jargon … So, let’s take a look at a few examples. Let’s saying you are receiving Social Security benefits for every month in 2023 and you:

- Are under full retirement age all year

You’ll be entitled to $800 a month in benefits, but you work and earn $31,20 during the year. How much do you actually get?

Your Social Security benefits will be reduced by $5,000 ($1 for every $2 you earned more than the limit – which, in this case, was $10,000 over the yearly limit). You’ll receive $4,600 of your $9,600 in benefits for the year.

- Reach retirement age in August of 2023

Similarly, you’re entitled to $800 a month which is $9.5k a year. But let’s say you work and earn $63,000 through the year – with $57,000 of it in the 7 months from January to July.

Your Social Security benefits would be reduced through July by $160. You’d still receive $5,440 out of your $5,600 benefits for the first 7 months. But beginning in August, you’ll receive your full $800 no matter how much you earn.

How earning in retirement impacts pension plans

When it comes to your pension benefits, it really depends on the type of pension or retirement benefit in question. Here’s a general overview, but we do recommend either looking further into your individual plans, or consulting a financial planner or tax professional to understand your exact situation.

- Defined Benefit Pension Plans (often called traditional pensions)

If you’re receiving a pension from a previous employer, and go back to work elsewhere, your pension will typically not be affected. However, if you retire and then return to work for the same employer? It may affect your benefits. That, of course, will depend entirely on the terms of that plan.

- 401 (k) and IRA Withdrawals

Over 59 and a half (yep pretty specific, we know!), you can withdraw from these accounts without penalty, regardless of your employment status or earnings. But if you’re under this age, withdrawals can be subject to a 10% early withdrawal penalty. However, this has nothing to do with earnings, and will, of course, vary depending on exactly which funds you’re using.

- Required Minimum Distributions (RMDs)

Once you reach a certain age (72, as of 2021), you must start taking RMDs from certain retirement accounts. If you’re still working and don’t own more than 5% of the company you work for, however, you may be able to delay RMDs from the 401(k) at the company until your retirement. But this doesn’t apply to IRAs or 401(k)s from previous employers.

Does that answer your questions regarding how earning money in retirement affects your benefits? We’ve done everything we can to break it down into simple facts, and put the power back in your hands in terms of retirement.

Because we all deserve to enjoy our next chapter of life, no matter our current financial situation or plans for the future.

If you’d like to learn more about the state of retirement today, tips and tricks on how to earn in retirement, as well as everything else retirement-related? Check out Earn Money in Retirement today.

Interested in connecting with others who are walking the same journey? Join the free Facebook group, Earning Money In Retirement to get support and inspiration.