Confused about retirement? Sick of reading blog posts for the “layman” about that only ever take you deeper down a rabbit hole? Just moved to the United States and have no idea what a 401(k) actually is? Don’t worry, we have you covered.

When it comes to retiring in the United States, you can get pretty caught up on complex jargon and all the hidden terms and conditions. And it definitely doesn’t help toward securing a stable, comfortable, and happy retirement. Especially when you’re already stressed out enough …

So? We’ve taken a deep dive into all things pensions and benefits, to help you decode U.S. retirement and explain everything in a way you’ll ACTUALLY understand.

Decoding U.S. Retirement: Understanding retirement basics

So, you probably have a basic understanding of retirement. It’s the rite of passage for many – the transition from decades of hard work on the hamster wheel, into a period of rest, reward for all your efforts and, most of the time, well-deserved leisure.

But if you know anything about the United States, there’s a big chance you know that the state of retirement today isn’t quite as simple as that.

It’s not as simple as just picking a date to stop work – it’s a multifaceted decision influenced by financial stability, health, social obligations and voernment-defined parameters.

So, what age actually is retirement-age? And how does that impact benefits?

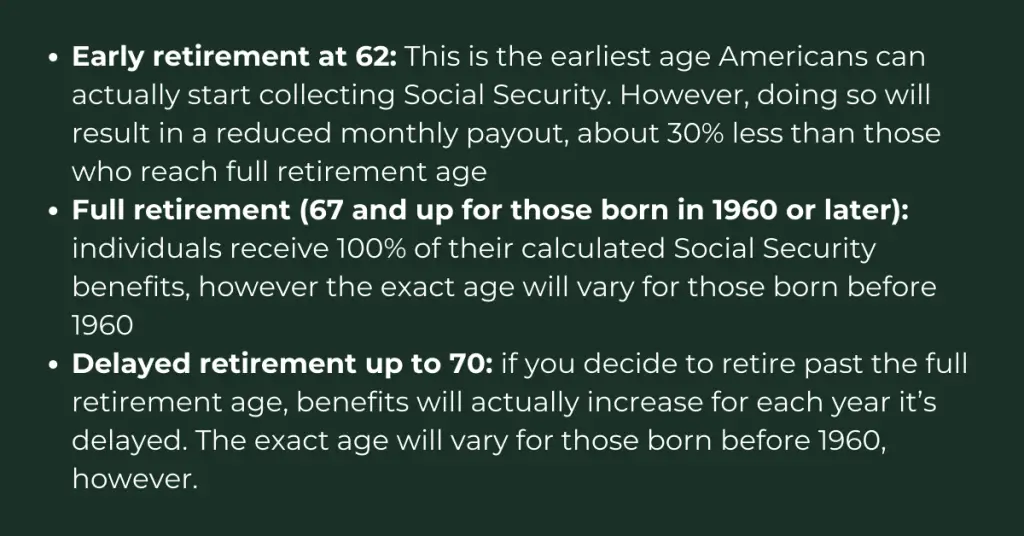

In the U.S., official retirement age benchmarks are mostly influenced by Social Security regulations, which have been known to shift around depending on the year you were born or age you are. Though retirement can technically commence anytime you feel financially prepared, certain ages are crucial for maximizing your government benefits:

When looking toward retirement, it’s crucial to think about the specific age you wish to retire, as it’ll affect your monthly income, overall retirement savings and lifestyle. By understanding these age benchmarks, you’ll be able to make an informed decision in terms of retirement planning.

Pension plans 101

So, now that you’ve got the basics downpat, the only question is exactly what benefits you need to consider when going into retirement.

And first on our list? Pension plans. Basically, a pension plan is a pool of money set aside by employers to fund payments made to employees after they retire.

There are two different types of pension plans but, in the United States, traditional pension plans – otherwise known as defined-benefit plans – have become increasingly rare and replaced by benefits that are much less costly to employers (pause while you roll your eyes) such as the 401(k) retirement savings plan.

- The Defined-Benefit Plan

In a defined-benefit plan, the employer guarantees that the employee will receive a specific monthly payment after retiring, and for life.

This amount is predetermined, based on a formula that typically takes into account factors like salary, years of employment and age.

But this monthly payment happens regardless of the performance of the underlying investment pool. So even if the assets in the pension plan account can’t pay for all the benefits? The company is still liable for the remainder.

- The Defined-Contribution Plan

In a defined-contribution plan, the employees themselves are left to make contributions, which may or may not be matched by the employer. The final benefit for the employee depends on the investment performance of the plan – the company’s liability ends when the total contributions are expended.

So, basically, the 401(k) is a defined-contribution pension plan, although the term “pension plan” itself is commonly used to refer to the traditional defined benefit.

Retirement benefits in detail

So, now that we’ve got pensions out of the way, it’s time to go over all the retirement benefits up for grabs in the United States.

- Social Security

Social Security is the social insurance program that provides financial assistance to people who are: retired, disabled, or survivors or deceased workers. It’s managed by the SSA, and there are several key components to the program. However, the main one retirees need to worry about are the Social Security Retirement benefits.

These benefits are paid to individuals who have worked a certain number of years and have reached the age of retirement (which is usually 62 or older, depending on the birth year). The amount of retirement benefits are calculated based on the individual earning history and the age at which you choose to begin receiving benefits.

It’s primarily funded through payroll taxes, with both employees and employers contributing to this program through these taxes. It’s a crucial safety net for many Americans, especially for those who have no other source of income in retirement. It’s one of the largest and most well-known social insurance programs in the United States, in fact.

- Private retirement savings and benefits

In the United States, there are multiple private retirement savings options to complement Social Security. These include your 401(k) plans and Individual Retirement Accounts (IRAs). Each of these savings options has their own unique advantages, features, tax treatment and rules regarding contributions and withdrawals.

Here’s a basic breakdown to help you get clear on what exactly each entail:

401(k) plan: As mentioned earlier, 401(k) plans are employer sponsored retirement plans that allow employees to contribute a portion of their (pre-tax) salary to a retirement account. These contributions are then invested – in stocks, bunds and mutual funds. Many employers today also offer a “matching contribution” up to a certain percentage of the employee’s salary to match the contributions made by the employee. The money in this account grows tax-deferred until it is withdrawn – but note, withdrawals made before the age of 59 ½ may incur a penalty.

Individual Retirement Account (IRAs): IRAs are retirement accounts that you yourself can open up, on your own, regardless of your employer. There are two main types of IRAs: Traditional and Roth. In a Traditional IRA, contributions are often tax-deductible and earnings growth tax-deferred until retirement. In a Roth IRA, contributions are only made AFTER tax, but earning and withdrawals in retirement are tax-free.

403(b) and 457 plans: Sound similar to a 401(k)? That’s because they are. But unlike 401(k)s, these are designed for employees of non-profit organizations, schools, and government entities, offering tax-deferred growth and funded with pre-tax contributions.

Annuities: Annuities are insurance products that can be used for retirement savings. They provide a stream of income through retirement which can be really beneficial for retirees. There are various types, however, including fixed, variable and indexed annuities.

Decoding U.S. Retirement: Making the most of your pension and benefits

When it comes to retiring in the United States, it’s crucial to know as much as possible about the available pensions and benefits to help you get a leg up in your savings. Even if you’re not anywhere near retirement, just having a good understanding of all resources will help you understand exactly what your job is offering, how best to start investing, and what exactly to keep an eye on in the news 😉

It’ll also help you plan when exactly to retire and whether or not it’s viable for you to consider a side hustle in retirement.

But if you’d like to learn more about budgeting in retirement, how earning in retirement will affect your benefits, or just the state of retirement today? Explore our full site for tips, tricks, guides, real-life stories and more on earning money in retirement.

And while you’re there? Consider joining our FB community here.